How Russia is exiting the Covid-19 induced economic crisis

It is now confirmed that Russia has emerged relatively unscathed from the crisis caused by Covid-19. The recession was less severe there than in the main developed countries and in particular in Europe. The rebound of hydrocarbon prices since the fourth quarter of 2020 has undoubtedly helped. But, the government seems more in a hurry to quickly resume a policy of austerity and balance the budget than to continue to support the economy, a choice whose consequences could be detrimental to growth.

The shock of the COVID-19 induced crisis

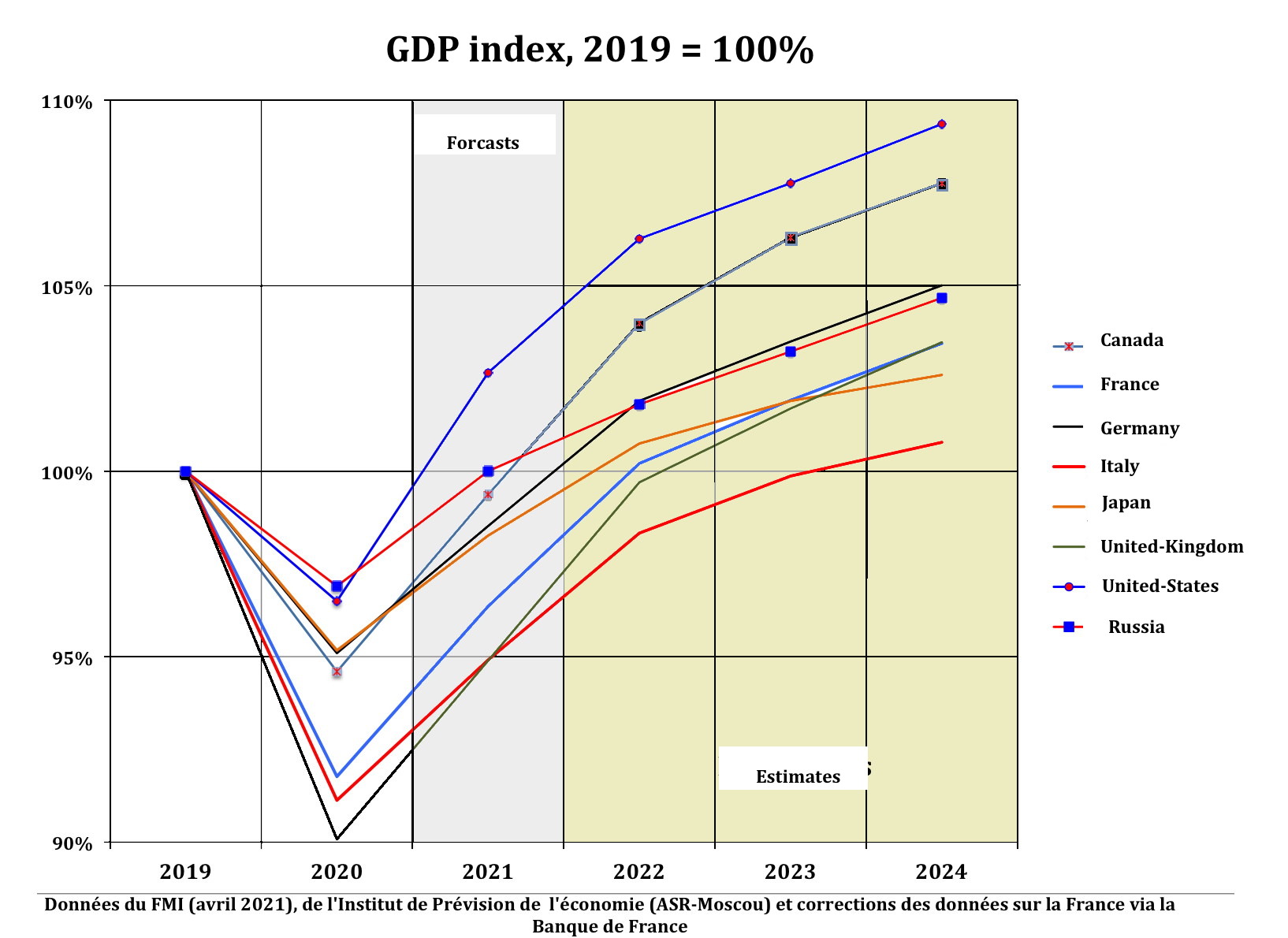

Russia has therefore suffered significantly less from the effects of COVID-19 than the G-7 countries. If the difference is small with the United States, it is much more important with the other countries, and in particular the European countries.

Graph 1

However, we can see that the rate of recovery of the economy is clearly below that of the United States (boosted by the various support and recovery plans of the Trump and Biden administrations), below that of Canada (no doubt driven by its neighbour) but also slightly lower than that of Germany. And this is made more obvious by the fact the Russian economy undoubtedly needs strong growth to complete the transformation that began in 2013-2015, according to researchers at the Institute for Economic Forecasting of the Academy of Sciences (IEF-RAS).

The role of hydrocarbons

The Russian economy has been boosted by the rapid rebound of hydrocarbon prices, which had fallen to their lowest level by April 2020. This results from the production restriction agreement that was reached by the OPEC countries and the countries of the non-OPEC group, not lead Russia. This agreement, which allowed prices to rise quickly, does not seem to have to be relaxed until gradually. The fall in exports was relatively moderate with -5.1% while imports fell by -13.7%.

This rebound in hydrocarbon prices took place in a context of stabilization of the exchange rate, or even of a further decline in purchasing power parity, in a context of recovery in export earnings.

Table 1

Change rate of Russian Rouble against USD

| Yearly average | 2019 | 2020 | Forecasts for 2021 | Estimates for 2022 | Estimates for 2023 |

| Rouble for 1 $ (nominal rate) |

64,7 |

72,0 |

73,8 |

72,4 |

73,5 |

| Rouble for 1 $ (in PPP) |

26,4 |

27,4 |

28,1 |

28,8 |

29,5 |

Source : IEF-ASR

This should limit the growth of imports which, in the context of the recovery in demand, will support domestic producers.

The stimulus factors

According to estimates by the Institute for Economic Forecasting, the growth in production in certain industrial segments that was observed at the start of 2021 is associated not only with a general recovery in demand after the acute phase of the economic crisis linked to the coronavirus, but also to significant support measures provided by the government to strategic companies at the end of 2020. However, the dynamic of public spending in 2021, marked by lower spending, could become one of the factors slowing the economy. Economic activity could become weaker in the second half of the year, when the effect of support measures will begin to weaken.

Table 2

Macroeconomic data

| GDP |

Households consumption |

State consumption | Investment | Budget incomes (GDP %) | Budget expenditures (GDP %) | Balance

|

|

| 2019 | 2,0% | 3,2% | 2,3% | 1,5% | 31,0% | 29,1% | 1,8% |

| 2020 | -3,1% | -8,6% | 4,0% | -6,2% | 31,5% | 35,9% | -4,4% |

| 2021 | 3,2% | 5,2% | 1,3% | 3,9% | 28,0% | 30,0% | -2,0% |

| 2022 | 1,8% | 2,0% | 1,3% | 3,0% | 27,2% | 27,9% | -0,6% |

| 2023 | 1,4% | 1,4% | 1,0% | 1,6% | 26,7% | 27,6% | -0,8% |

Source : IEF-ASR

The Russian economy has reacted well to various monetary and budgetary stimuli. With the exception of the oil and gas sector and activities, which were directly dependent on the epidemiological situation, in all other sectors the recovery of production and demand in the 1st quarter of 2021 was quite active. But, at the same time, the reduction in the fiscal stimulus policy will, most likely, lead to a return to economic growth rates of 1.5-2% as early as 2022-2023, after the recovery of production in 2021. In At the same time, a slow and uncertain return of global demand for hydrocarbons to its 2019 level, and the IEA does not announce it until 2023, could become an additional factor limiting growth. Forecasts are based on an average price of oil (Brent) of 61-62 USD per barrel for 2022-2023. Even if the price were to be in 2022 around 70 USD, this would only push the growth forecast to 2% -2.5% per year, which is insufficient to guarantee a harmonious development of Russia.

Other growth factors?

It is therefore necessary to look at what could be the other growth factors that could be mobilized to support the recovery after 2021.

Of course, investment and consumer demand can support an acceptable pace of economic recovery. But who actually needs priority support? If it is assumed that consumer demand will pick up under the influence of large macroeconomic aggregates, then it would be natural to focus on supporting investment. So the growth in income and demand of the population would be the end result of economic dynamics. However, there are strong arguments in favour of the fact that the growth of the incomes of the population should be a priority, which should become the main growth factor and a necessary condition to launch the investment cycle and overcome the consequences of the crisis as quickly as possible. To achieve such a result, budgetary expenditure would have to be significantly higher than what is currently planned.

A sustained recovery in demand would also come from the presence of deferred demand from the population who could not consume during periods of confinement, low remunerations on bank deposits and continued restrictions on travel abroad. In general, all of this is considered to offer a potential for household consumption growth of 5% or more. However, this growth in consumption may face structural constraints, especially if the government maintains its plans to increase contributions to pension funds and health insurance. The point is that the potential for increased consumption by higher income population groups is limited. Even under the conditions of a decrease in the attractiveness of deposits and other financial instruments, one can expect a rather limited increase in demand from this part of the population. A further restriction of internal demand may arise in the event of the opening of the external borders due to notable progress in the field of vaccination.

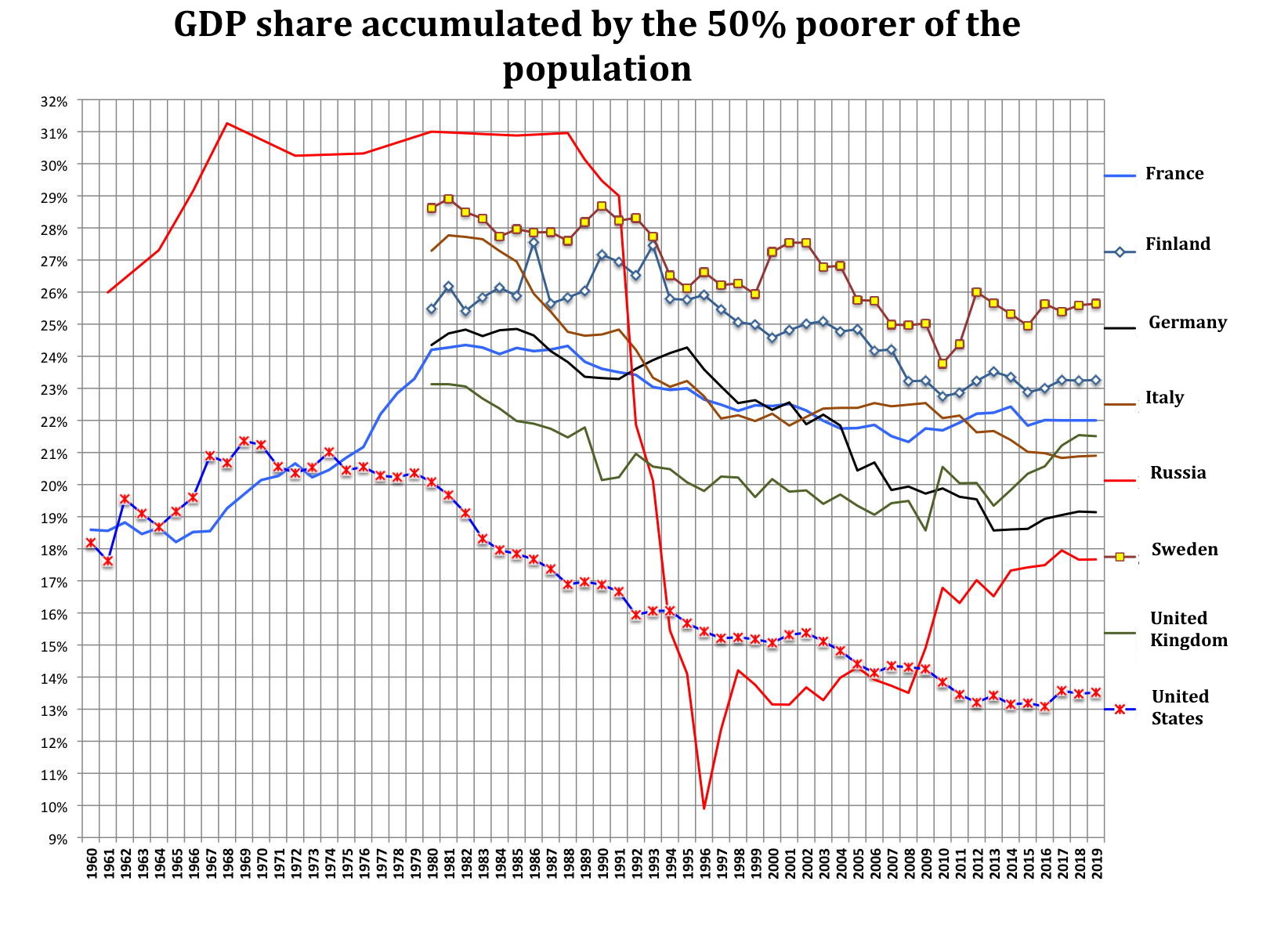

The economic need for social policy

The low- and middle-income groups of the Russian population, meanwhile, have retained significant growth potential in consumer demand. While the poorest part of the population, represented by the population whose income is below the median (the poorest 50%), have seen their situation improve relatively in recent years, there is still significant room for improvement. A policy targeting these categories would certainly have a strong effect on population demand and this would have very positive effects on growth.

Graph 2

However, its implementation would require the continuation of measures guaranteeing the improvement of the lowest incomes. In this regard, for example, actions of limited scope to increase wages in the public sector, or to expand the level of social support to low-income families, could become a necessary condition for achieving growth in the consumption of the population. This is particularly important if we keep in mind the consumption and income levels in 2013, which remain an objective whose achievement should become a guideline of social policy in the years to come.

The growth in population demand would also make it possible to give more importance to production facilities geared to domestic demand and to encourage investment in that part of the economy which does not directly depend on the actions of the State. .

Fiscal policy choices will therefore be decisive in ensuring sustained growth in 2022 and 2023, and these choices should be made by summer 2021 at the latest. A social turning point in Russian fiscal policy, besides being socially and politically justified, could prove to be decisive economically. In general, the current macroeconomic conditions make it possible to anticipate economic growth rates of up to 4% in 2021. Such a dynamic would make it possible to use the growth potential of the Russian economy more effectively and to evolve in 2022 -2025 to growth rates of 2.8-3.5% based on the launch of a new round of investment in the private and public sectors of the economy.

Les commentaires sont fermés.